MADISON, Wis. — Mere days after the start of the 2023 session of the state legislature, Republican leaders are already busy trying to rig the system to benefit their wealthy backers and special interests.

Instead of working with Governor Evers on his proposal to deliver tax savings for the middle class and local families, GOP leaders today unveiled a scheme that would provide little or no benefit for working people while delivering a windfall for the wealthiest.

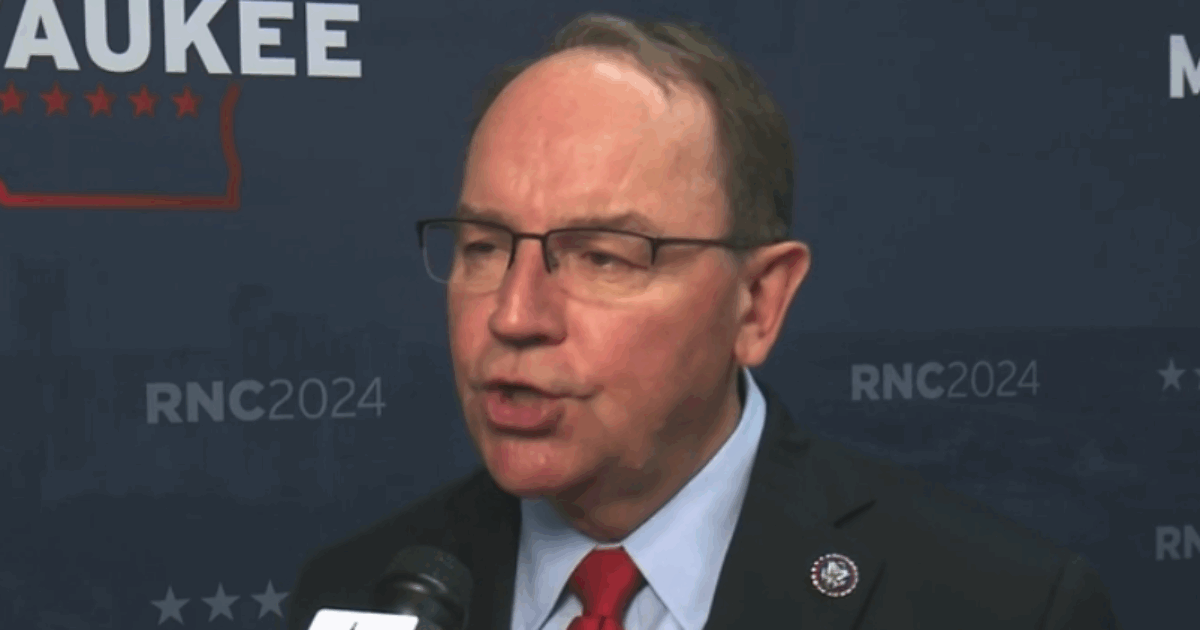

Republican Senate Leader Devin LeMahieu this week introduced a tax plan similar to what expert economists say would benefit only a small percentage of the state population. Under the plan, the average working Wisconsin family would see almost no benefits compared to the wealthy.

While Assembly GOP leader Robin Vos declared in his inauguration speech that he sees nothing wrong with tax schemes that let the wealthiest dodge paying what they owe, voters in the fall elections chose Gov. Evers’ plan for a middle class tax cut.

According to Chris Walloch, executive director of A Better Wisconsin Together, Vos and other Republican leaders backing the regressive flat tax plan have it all wrong.

“There absolutely is something wrong with a tax plan skewed to help the wealthiest more than others,” said Walloch. “It’s a highly transparent pander to these politicians’ wealthy donors, and a slap in the face to hardworking Wisconsin taxpayers.

“The tax plan Wisconsinites deserve, and what they voted for in November, is one that puts more money in the pockets of local families and ensures quality schools, affordable healthcare, and good-paying jobs – so that all of our families can thrive,” Walloch added.

That’s exactly what Gov. Tony Evers has proposed with his plan that would increase public school funding, lower property taxes, and give Wisconsin families a hard-earned 10% middle-class tax cut.

“For too long, a handful of Republican politicians have let greedy corporations rig the rules to favor their campaign contributions over our contributions for each other,” said Walloch. “They have tried to divide us, fueling fears based on our tax bracket. It’s about time that Wisconsinites reject this division and demand our leaders make the wealthiest pay what they owe, while also helping average families get ahead for once.”

Together, we can demand that our elected officials ensure that the wealthiest pay what they owe in taxes – taxes that will help our schools, hospitals, parks, and programs all that our families deserve. Call your legislator today at 1-800-362-9472 and tell them it’s time to put people over profits.